Identity theft is fraud. This is when someone illegally finds and uses your personal information to access your money. Criminals may try to hack your bank account, apply for credit in your name (such as a home loan or store card), or use your credit card to buy things online.

Which cards have identity theft and fraud protection?

Most credit cards come with fraud protection, but the details and processes differ between lenders. Check your credit card’s website to see the details of its fraud protection guarantee.

To help you out, here are some of the best protections against identity theft.

There are general fraud protection terms and conditions, so check the card’s PDS for details.

| Brand | Fraud protection | Money-back guarantee against fraud | Online Protection | Instant card lock |

|---|---|---|---|---|

| American Express | Fraud control: an advanced bot that detects fraudulent transactions and notifies you immediately via SMS or email. You can reply Y to confirm the transaction or call Amex to report the activity as fraudulent. | Amex will reimburse any money lost as a result of fraudulent transactions as long as you have not contributed to or delayed reporting the fraudulent transactions and you have complied with the card’s terms, such as taking reasonable precautions to protect your card details and your account. | American Express security key: confirms your identity by requesting additional information when shopping online with certain merchants, for example by requesting a dynamic one-time code sent by email or SMS. | ✔ Log in through the American Express online account portal. |

| ANZ | ANZ Falcon: 24/7 fraud protection that identifies suspicious transactions. ANZ will contact you to confirm the transaction and may temporarily freeze your card. | As long as you promptly notify ANZ of the fraudulent activity and have not contributed to any loss of funds, ANZ will credit your account for the stolen amount. | Secure visa: free services that give you added protection when you shop online at participating merchants. | ✔ Via the ANZ app under Card > Manage > Manage card > Temporarily block card |

| NAB | NAB Defense: Where you see the NAB Defense logo, you will be protected against fraud (using your physical card or digital wallet), provided you meet your responsibilities as a cardholder. | NAB says you will be refunded the amount taken from your account if, against all its best defenses, you are the victim of fraud. | SMS Security: Provides unique authentication codes when using online banking or the NAB app. It protects your accounts even if your NAB ID and password fall into the wrong hands. | ✔ Via the NAB app under My cards > Block card |

| Westpac | Westpac’s fraud detection team will send a text message if unusual activity is detected. | As long as you have not disclosed any security information, including your PIN, and have met the card’s security requirements. | Security of digital cards: the 3-digit security number for your digital wallet (and online payments) is updated every 24 hours to keep your information safe. | ✔ Via the online banking portal or Westpac app under Cards > Temporarily lock card |

| Citi | Early warning of fraud: Citi monitors your spending to spot unusual or high-risk transactions. You will receive a two-way SMS alert to confirm the transaction. | As long as you have not disclosed any security information, including your PIN, and have complied with the card’s security requirements. | Use biometrics such as facial recognition and fingerprint technology to secure your information online. | ✔ Via the Citi mobile app under Card Settings > Lock Card |

How does identity theft affect you?

Besides giving you a punch in the gut feeling, identity theft can have real-world ramifications. If the fraudsters apply for loans in your nameincluding home loans, personal loans, cell phone plans or credit cards and then fail to repay those loans (which they will), the black marks will be recorded on your credit report.

Past due payments are kept on file for two to five years, and every lender that checks your credit profile will see them. This may affect your own term loan approval.

Identity theft also means that you will have to make a complete audit of all your accountschange passwords and use better password protection, such as two-step authentication.

How to protect yourself against credit card fraud?

Fraudsters can use information from your driving license, birth certificate or passport to access money or credit, or they can obtain your debit or credit card details.

As convenient as online spending and instant payments are, they also open up a world of opportunities for fraudsters. Now thieves can buy anything costing less than $100 with a simple tap or swipe, with no PIN or card verification required.

For example, recently I helped someone whose credit card was stolen and watched in real time as the thief made six transactions (all under $100, sometimes two transactions at one store) at pet stores , supermarkets and gas stations. Clearly, the criminal life is hard work as the bandit also indulged in a pizza worth $65.

Fortunately, the victim was able to contact their bank, which froze their card (some apps allow you to do this instantly, like the Citi mobile app). His money was refunded under his credit card’s anti-fraud guarantee, and the criminal was eventually found using the store’s security cameras.

The pizza was never found.

You can reduce your chances of having your identity stolen by following a few basic security rules:

- Shred any letters or documents bearing your name and personal information before throwing them away.

- Put a lock on your mailbox

- Keep an eye on your bank and credit card accounts for purchases you didn’t make.

- Avoid public Wi-Fi if you check your bank accounts or buy something online.

- Use highly rated security software on your computer, especially software with additional security features for online banking and spyware protection.

- Update your banking passwords with a stronger and longer password with a combination of letters, numbers, capital letters and special characters.

- Never share personal information on social media or via email, text or messaging.

- Be wary of messages on WhatsApp, Facebook Messenger and Instagram pretending to be a family member or asking for money.

- Choose credit and debit cards with an electronic chip (a smart card) if possible, as they are even more secure than cards with a magnetic stripe.

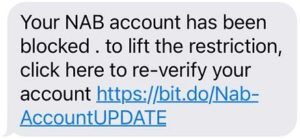

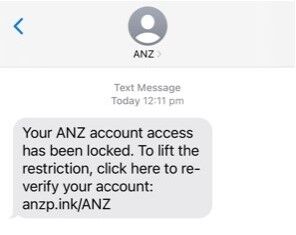

- Do not click on links in text messages or emails asking you to log in or share personal information (called phishing).

Be on the lookout for phishing scams

We all learned a lesson from Optus data breach in September 2022 to be careful with our personal data. But fraudsters went further, using text messages to phish vulnerable people caught in the breach and pretending to be from Optus or their bank.

Email phishing or SMS scam (called SMishing) is a popular way for criminals to gain access to your data by pretend to be a legitimate messagerequiring you to click on a link and enter your details. Here are some examples:

Phishing gets even sneakier because scammers can fake the phone number and bank name, so their message appears in the same conversation as legitimate messages from your bank.

It is important to know that banks do not:

- Ask you to click on a link in an email, text message or Whatsapp so that you can confirm or update personal information or transactions.

- Asks you to transfer money to another account.

Most banks have a page on their website with the latest security alerts and scamsso you can first check any messages you receive bearing the bank’s name.

If in doubt, don’t click. Call your bank first. If you’re unsure about a phone call claiming to be from your bank, hang up and call the bank to verify. They won’t be offended.

Use fraud protection on your credit card

Fraud protection is part of the terms of your credit card (remember, it’s also in the bank’s interest to keep fraud to a minimum!). You may have the option to sign up for additional security features such as NAB SMS Security.

If you believe your account has been used fraudulentlycontact your card issuer immediately. Most of the time, you can instantly lock your card to stop any further transactions through your card’s app or online portal.

From there, the process can differ between credit card companies, but generally involves an investigation into the fraudulent activity and then a refund if it is agreed that you are not responsible.

⭐A note about microchips: Many credit card companies are adopting CHIP technology, which stores your data on a chip embedded in the card rather than on the magnetic stripe. If chip cards are available from your credit card provider, you will receive one when your card renews.

What to do if you’ve been scammed or your identity stolen

- Contact your credit card issuer (this also includes losing your card)

- Work with your card issuer and the police to open a case for fraudulent activity against your name.

- Have a credit check done to see if any damage has been done to your credit score. Contact all institutions that have recorded a default following a fraud-related missed payment.