In this blog, we will cover and discuss the FHA 203k mortgage process and eligibility requirements. The Gustan Cho Associates team is experts in originating and financing $203,000 FHA loans. FHA 203,000 loans allow home buyers to buy renovations and will lend for acquisition and renovation in one lending program. Home buyers need 3.5% of the after-improvement value.

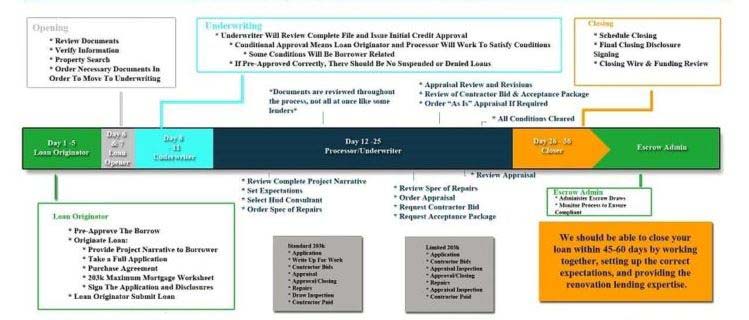

Here is a chart of how the FHA 203k mortgage process works:

In the following paragraphs, we will discuss the FHA 203k mortgage process for home buyers purchasing remodeling homes and eligibility requirements.

Table of contents “Click here”

How the FHA 203k Mortgage Process Works

Many people assume that there is a lot of red tape in the FHA 203k mortgage process. This is not the case. Understanding the FHA 203k mortgage process before applying for a loan will avoid stress during the mortgage process and make the FHA 203k mortgage process much smoother. To make the mortgage process smooth, buyers, sellers, loan officers, real estate agents and contractors must work as a team. The FHA 203k mortgage process is slightly longer than a traditional FHA loan process. It normally takes between 45 and 60 days from pre-approval to closing.

Pre-approval stage of the FHA 203k mortgage process

The pre-approval stage of the mortgage process is the most important step. The loan officer must thoroughly qualify the borrower, the property, the extent of the renovation work and other important factors before beginning processing and underwriting the FHA 203k mortgage process. The number one reason for a last minute mortgage rejection and/or stress during the mortgage process is that the loan officer did not properly qualify the borrower. All documents must be carefully reviewed, analyzed and ensured that they are complete.

Steps in the FHA 203k Mortgage Process

The following steps must be completed before issuing a pre-approval. Make sure borrowers meet all requirements HUD Guidelines. If the lender has lender overlays, make sure borrowers comply with the company’s lender overlays. All mortgage documents such as income documents, credit report, assets and liabilities, tax returns, bank statements and other documents should be carefully reviewed. Run automated subscription system and ensure borrowers can meet all AUS requirements.

Benefits of FHA 203k Renovation Loans

203k renovation loans are the next step toward a custom home. Homebuyers can purchase renovations and customize renovations to their liking. Home buyers can make room additions and second floor additions. They can perform complete intestinal renovations/rehabilitation. Interior repairs such as flooring, carpentry, basement and attic, HVAC, new appliances, kitchens, bathrooms and countless other repairs. Exterior repairs such as driveways, roof, windows, soffits/fascia/gutters, foundation, well/septic and countless other repairs/renovations. Luxury renovation/renovation projects such as swimming pools, outdoor kitchens and tennis courts are not permitted.

Processing Stage of the FHA 203k Mortgage Process

Once a home buyer signs a contract, the executed purchase agreement must be submitted to the loan officer along with the updated mortgage documents. The file will be assigned to a mortgage processor. The processor will carefully review the documents provided. If any items are missing, the processor will request them from the borrower, loan officer, real estate agent, or other parties. The processor will not submit the file to a mortgage underwriter until it is completely finished. The primary goal of mortgage loan processors is to obtain conditional loan approval with as few conditions as possible by the subscriber. Once the file is completed, the file is entrusted to a mortgage underwriter.

Underwriting Stage of the FHA 203k Mortgage Process

Once the mortgage underwriter has thoroughly reviewed the file, they will issue a conditional approval of the mortgage loan. The conditional approval is sent to the processor. The mortgage processor then gets back to work and begins putting together the terms requested by the underwriter. Examples of conditions may be:

- Updated bank statements

- Updated employment verification

- Letters of explanation on the commercial lines indicated on the consumer credit report

- Letters of explanation regarding borrowers’ credit, income, assets, liabilities, employment, residence and/or other factors requiring clarification

- Request information and/or details about the HUD Consultant

- Clarification and/or additional details on the scope of work

- Request the FHA 203k appraisal as-is and complete

- Request a quote from the contractor

Clearing conditions and closing authorization

Once all conditions have been submitted to the mortgage underwriter, the mortgage underwriter will thoroughly review the conditions and if all have been met, will issue a Closing Authorization. A clear loan to close means the lender is ready to prepare the closing documents and fund the loan. The lender’s closing department will contact the title company and make arrangements for the closing time and date. The final final information will be disclosed and sent to all parties. Closing documents will be sent to the title company. The final pre-financing review will be carried out by the lender while all of this is carried out and will do a QC compliance review. agency guidelines were encountered.

Types of FHA 203k Renovation Loans

There are two types of FHA 203k loans: standard and streamlined 203k loans. FHA 203k streamlines are intended for cosmetic repairs only. Standard 203,000 loans are for any type of home renovation, including structural changes and room additions. Both types of 203,000 loans have the same requirements and are processed and underwritten in the same way. Maximum acquisition and construction costs are capped at FHA County Boundary. A maximum of one general contractor. Maximum of 5 draws allowed to general contractor on full FHA 203k loans. Structural changes and room additions are allowed on Standard 203k loans.

FHA 203k Streamlines Renovation Loans

FHA 203k Streamlines Renovation Loans are intended for cosmetic repairs.

- Rehabilitation cost capped at $35,000.

- No HUD consultant required

- No structural work authorized

- Maximum of 2 payments per contractor

For more information on this and/or other mortgage-related topics, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a quicker response. Or email us at gcho@gustancho.com.